What Do I Do With All This Stuff? Your Guide to Selling a Probate Property Full of Belongings

You've just been named executor or administrator of an estate. You walk into the property for the first time and your heart sinks. The house is full-decades of furniture, boxes in every closet, a garage packed to the ceiling, and personal items scattered throughout.

Your first thought: "What do I do with all this stuff?"

Your second thought: "I can't sell the house like this."

Your third thought: "This is going to take forever."

I see this scenario almost weekly in my probate real estate practice. Personal representatives feel overwhelmed, embarrassed, and uncertain about where to begin. But here's what I want you to know: This situation is completely normal, you have more options than you think, and with the right strategy, you can navigate this efficiently.

First Things First: Don't Be Embarrassed

Before we dive into solutions, let me address something important: Many personal representatives apologize to me before I even walk through the door. They're embarrassed about the condition of the property, worried about what I'll think, and sometimes they've spent days trying to clean up before my arrival.

Please don't do this.

A house full of belongings is the norm in probate situations, not the exception. In nearly a decade of working with estates, I've seen every possible scenario. Most often, the deceased was older, perhaps dealing with declining health toward the end of their life. The upkeep of the home became too much to manage. This is typical.

There is nothing in your loved one's property that will shock me or that I haven't encountered before. My job is to help you navigate the situation as it is, not to judge how it got that way.

Understanding Your Real Challenge: Time vs. Money

The central question you're facing isn't really about the stuff-it's about time and money, and how they relate to each other.

Here's what many personal representatives don't initially realize:

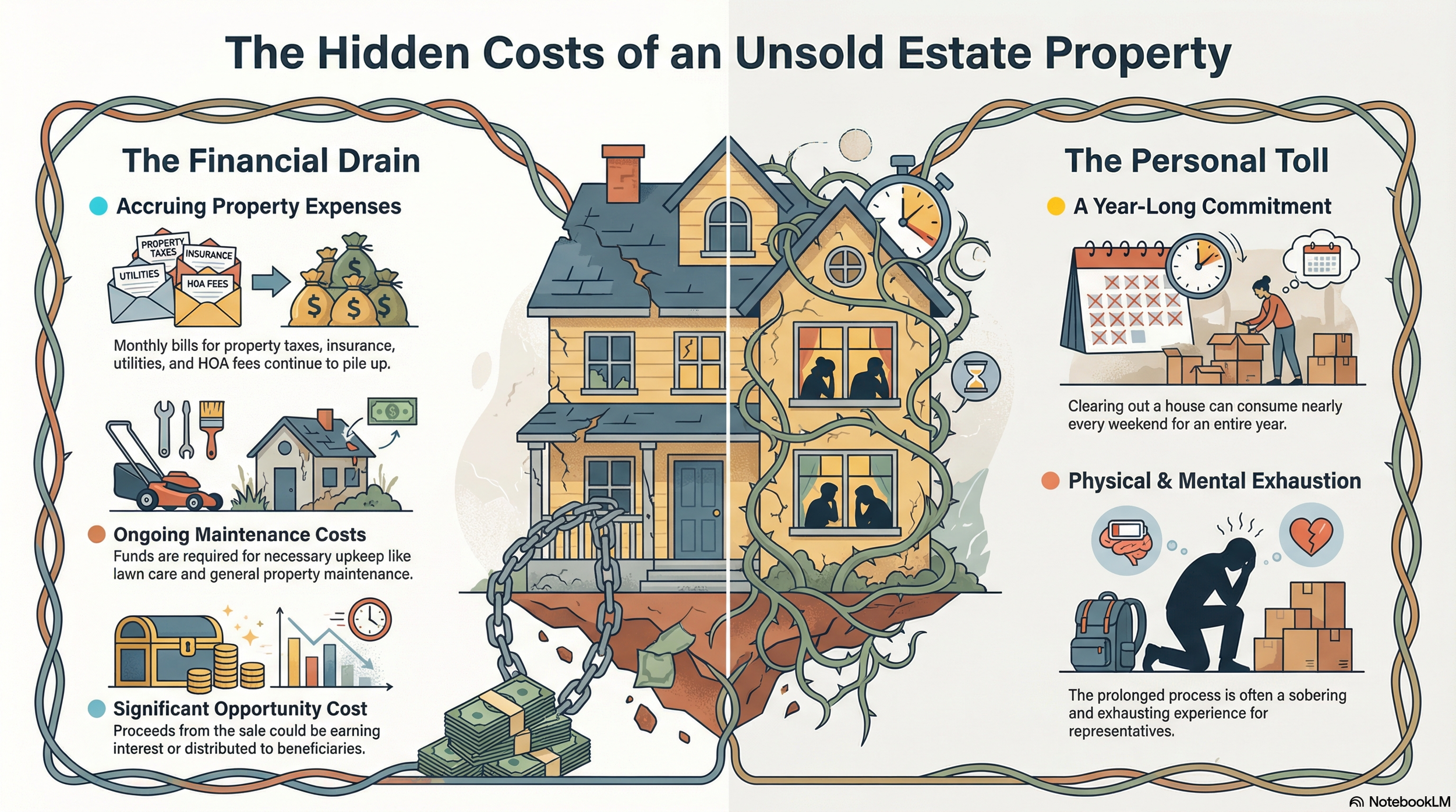

Every month that property sits unsold costs real money:

• Property taxes continue accruing

• Insurance premiums are due

• Utilities need to be maintained

• HOA fees may apply

• Lawn care and maintenance are necessary

• Opportunity cost-the proceeds could be invested or distributed

I've talked with personal representatives who started clearing out a house in January and by December were exhausted, having spent nearly every weekend for a year working on the project. When we calculate the actual costs-both financial and personal-the numbers are sobering.

Understanding this time-money relationship is crucial to making smart decisions about how to handle the personal property.

Your Two Real Options (And Why ‘Off Market Cash Offers’ Aren't Probably One of Them)

When it comes to dealing with personal property in a probate estate, you have two legitimate paths forward. But first, let me address what you should avoid.

What You're Probably Being Told: "Just Sell to a Cash Investor"

Many personal representatives receive calls and letters from investors offering to buy the property as-is, full of belongings, for a quick cash close. It sounds tempting when you're overwhelmed.

Here's the reality: These offers typically come in at 50-70% of what the property would sell for on the open market. On a $400,000 property, you could be leaving $120,000-$200,000 on the table.

As a personal representative, you have a fiduciary duty to maximize the estate's value. Accepting a lowball offer because you're overwhelmed by belongings isn't fulfilling that duty, especially when you have better options.

My entire business exists to show you there's usually a better way. Let's talk about your actual options:

Option 1: Handle It Yourself

This means you and family members physically sort, organize, distribute, sell, donate, and dispose of every item in the property, then list it at full market value.

This makes sense when:

• The estate has minimal belongings

• You live locally and have significant time available

• Multiple family members can share the workload

• Many items have sentimental value that family wants

• There's no time pressure on the estate

Be realistic about:

• This takes 3-5 times longer than you think it will

• It's emotionally exhausting to sort through a loved one's lifetime of belongings

• Family conflicts over distribution are common

• Every month of delay costs money in carrying costs

• The physical labor is demanding

Option 2: Use Professional Services and List at Full Market Value

Professional estate services handle the evaluation, organization, sale, and removal of personal property. Then we list the property at full market value and get you what it's actually worth.

This is the right choice when:

• You live out of state or far from the property

• The property has decades of accumulated belongings

• You need to sell relatively quickly

• Your time is limited due to work or family obligations

• The property may contain valuable items

• You want to maximize the estate's net proceeds

What you gain:

• Property is market-ready in weeks, not months

• Professional evaluation ensures nothing valuable is missed

• Sale proceeds from personal items often offset service costs

• Massive reduction in your stress and time commitment

• Property sells at full market value, not a 30-50% discount

• All logistics handled by professionals

The Hybrid Approach: Best of Both Worlds

Most often, the optimal solution combines both approaches:

• Family visits once to collect sentimental items

• Professional service evaluates and sells valuable items

• Donation services pick up usable items (tax deduction for estate)

• Junk removal handles final clearing

• Property lists at full market value and sells for what it's worth

This approach honors your loved one's memory by preserving sentimental items, maximizes the estate's value, and gets the property sold efficiently without shortchanging beneficiaries.

The Hard Truth About Used Furniture Values

One of the most important conversations I have with personal representatives involves managing expectations about what used furniture and household items are actually worth in today's market.

That beautiful dining set purchased in 1974 for $7,000? In today's used furniture market, it might sell for a few hundred dollars, not thousands. Even if it's been impeccably maintained.

Why the dramatic depreciation?

• Modern furniture is relatively inexpensive to buy new

• Style preferences have changed significantly

• Large furniture pieces are difficult and expensive to move

• Many buyers prefer different aesthetics than previous generations

• The market is saturated with used furniture from downsizing baby boomers

This doesn't mean the items had no value or that your loved one made poor purchases. It simply reflects market reality. Understanding this helps you make practical decisions about what's worth selling versus donating or disposing.

That said, certain items do retain or increase in value: quality antiques, collectibles, jewelry, artwork, and specialty items. This is where professional evaluation can help identify hidden value that you might otherwise miss.

Case Study: The Out-of-State Personal Representative

Let me share a recent case that illustrates how these principles play out in real life.

A gentleman in New York was appointed executor of his relative's estate in Texas. He flew down to assess the situation and was immediately overwhelmed. The property was full-not neglected or in terrible condition, but simply full of decades of belongings.

His initial plan was to fly back and forth over several months, spending weekends sorting through everything himself. He calculated this would save money on professional services.

When we sat down together, I walked him through the actual costs:

• Monthly carrying costs on the property: ~$2,000

• Round-trip flights from New York (estimated 6 trips): ~$3,000

• Hotels and car rentals: ~$2,000

• Time away from his job and family: Incalculable

• Physical and emotional exhaustion: Significant

• Estimated timeline: 5-6 months

The professional estate service approach:

• Complete property clearing: 2-3 weeks

• Service cost: Offset by auction proceeds from saleable items

• His required trips to Texas: 1 (to select sentimental items)

• Property ready to list: Within one month

• Saved carrying costs: ~$10,000+

He chose the professional route. The property sold quickly once listed, and he was able to close the estate efficiently while maintaining his own life and career in New York.

The key lesson: What initially appears to be saving money often costs far more when you calculate the full financial and personal costs.

My Role as Your Probate Real Estate Broker

When personal representatives contact me about selling a probate property, they often assume I'm only focused on listing and selling the real estate. But my approach is different.

I serve as a strategic advisor for the entire process.

Here's what that means:

Education First:

I help you understand all your options-not just the one that gets the property listed fastest. My goal is to help you make informed decisions that maximize the estate's value while minimizing your stress and workload.

Resource Connection:

Through nearly a decade of specializing in probate real estate, I've built relationships with trusted professionals who serve estate clients exceptionally well-estate liquidation services, junk removal companies, donation coordinators, contractors for repairs, title companies familiar with probate, and attorneys when needed.

Honest Assessment:

Sometimes the best advice I give is that a client doesn't need professional estate services-that family can realistically handle the clearing in a reasonable timeframe. Sometimes I recommend against making repairs before selling. My job is to give you honest guidance, not to maximize my commission or push services you don't need.

Market Expertise:

I help you understand what your specific property will realistically sell for in various conditions-as-is full of belongings, as-is empty, or with improvements. This allows you to make fact-based decisions rather than guesses.

Fiduciary Mindset:

While I'm not the fiduciary (you are), I approach every probate sale with a fiduciary mindset. That means I'm always thinking about maximizing estate value, minimizing risks, and ensuring compliant processes. Your success as a personal representative is my success.

Common Mistakes Personal Representatives Make

In my years of specializing in probate real estate, I've seen certain mistakes repeated frequently. Avoiding these can save you thousands of dollars and months of frustration:

Mistake #1: Underestimating the Time Required

Clearing a property always takes longer than you think. What looks like a weekend project becomes months of weekends. Factor in realistic time estimates before committing to DIY clearing.

Mistake #2: Not Calculating Carrying Costs

Every month you delay costs money. Add up all the actual costs and compare them against service fees. The professional route often costs less than extended DIY timelines.

Mistake #3: Accepting Lowball Cash Offers Out of Overwhelm

This is the mistake that costs estates the most money. When you're overwhelmed by a property full of belongings, investor cash offers sound appealing. But these offers typically come in at 50-70% of market value. On a $400,000 property, that's $120,000-$200,000 left on the table. My job is to show you that with the right support, you can get full market value without taking on all the work yourself. Don't let overwhelm cost the estate six figures.

Mistake #4: Throwing Away Valuable Items

In the rush to clear a property, families sometimes dispose of valuable items without realizing their worth. Have a professional evaluate before major disposal decisions.

Mistake #5: Creating Family Conflicts Over Distribution

Personal property distribution can create lasting family rifts. Establish clear, fair processes early and consider professional mediation for high-conflict situations.

Mistake #6: Not Securing the Property

Empty properties being cleared are vulnerable to theft. Change locks, install security measures, and maintain proper insurance throughout the process.

Mistake #7: Trying to Sell Property Before Authority is Granted

You cannot legally sell probate property until you have letters testamentary or letters of administration from the court. Spending money clearing property before you have legal authority to sell it is risky.

Your Action Plan: Next Steps

If you're facing a probate property full of belongings, here's your strategic action plan:

Step 1: Secure the Property

Change locks, verify insurance is current, and ensure utilities stay on for safety and property preservation.

Step 2: Document Everything

Take photos and video of the property and its contents. This protects you from later claims by heirs and provides records for insurance purposes.

Step 3: Get Professional Evaluations

Have both the real estate and significant personal property professionally evaluated. This gives you factual information to make decisions rather than guesses.

Step 4: Calculate True Costs

Add up monthly carrying costs, your time, travel expenses, and opportunity costs. Compare these against professional service fees for a realistic cost-benefit analysis.

Step 5: Create a Realistic Timeline

Based on your actual available time and the property's condition, estimate how long each approach would realistically take. Then add 50% because these projects always take longer than expected.

Step 6: Communicate With All Interested Parties

Before making major decisions, communicate clearly with all heirs and beneficiaries. This prevents conflicts and ensures everyone's concerns are heard.

Step 7: Make an Informed Decision

With good information and professional guidance, choose the approach that best balances maximizing estate value, minimizing costs, and reducing your personal burden.

Step 8: Execute Efficiently

Once you've decided on an approach, move forward decisively. Delay costs money and prolongs stress for everyone involved.

The Bottom Line

A property full of personal belongings doesn't have to derail your probate sale or become a source of ongoing stress. With realistic expectations, good information, and the right support team, you can navigate this challenge efficiently while maximizing the estate's value.

The key is making informed decisions rather than reactive ones. Don't let overwhelm push you toward quick cash offers that shortchange the estate by tens of thousands of dollars. And don't let pride or a desire to save money trap you in a year-long DIY project that costs more than professional help would have.

As a probate real estate specialist with nearly a decade of experience in Central Texas, my job is to help you see all your options clearly and make decisions that serve the estate's best interests while respecting your personal circumstances.

Every situation is unique. What worked for the New York executor might not be right for you. What makes sense for a small estate might not apply to a large one. Local versus out-of-state personal representatives face different considerations.

That's why I start every relationship with a consultation rather than a sales pitch. We'll discuss your specific situation, explore your options, and create a strategy tailored to your estate's needs. No pressure, no obligation-just honest guidance to help you move forward confidently.

Ready to Develop Your Strategy?

If you're dealing with a probate property in Central Texas-in Travis, Williamson, Hays, Bell, or Bexar County-and you're uncertain about the best way forward, let's talk.

Schedule a free, no-obligation consultation where we'll:

• Review your specific situation and timeline

• Discuss realistic options for handling personal property

• Provide a realistic property valuation in various scenarios

• Answer your questions about the probate sales process

• Create a preliminary action plan tailored to your estate

We'll meet on Zoom at a time convenient for you. This is an educational conversation, not a sales pitch. My goal is to help you understand your situation clearly so you can make confident decisions-whether you ultimately work with me or not.

Contact Texas Probate Real Estate today to schedule your consultation. Let's turn that overwhelming property full of stuff into a successful estate sale and a closed probate case.